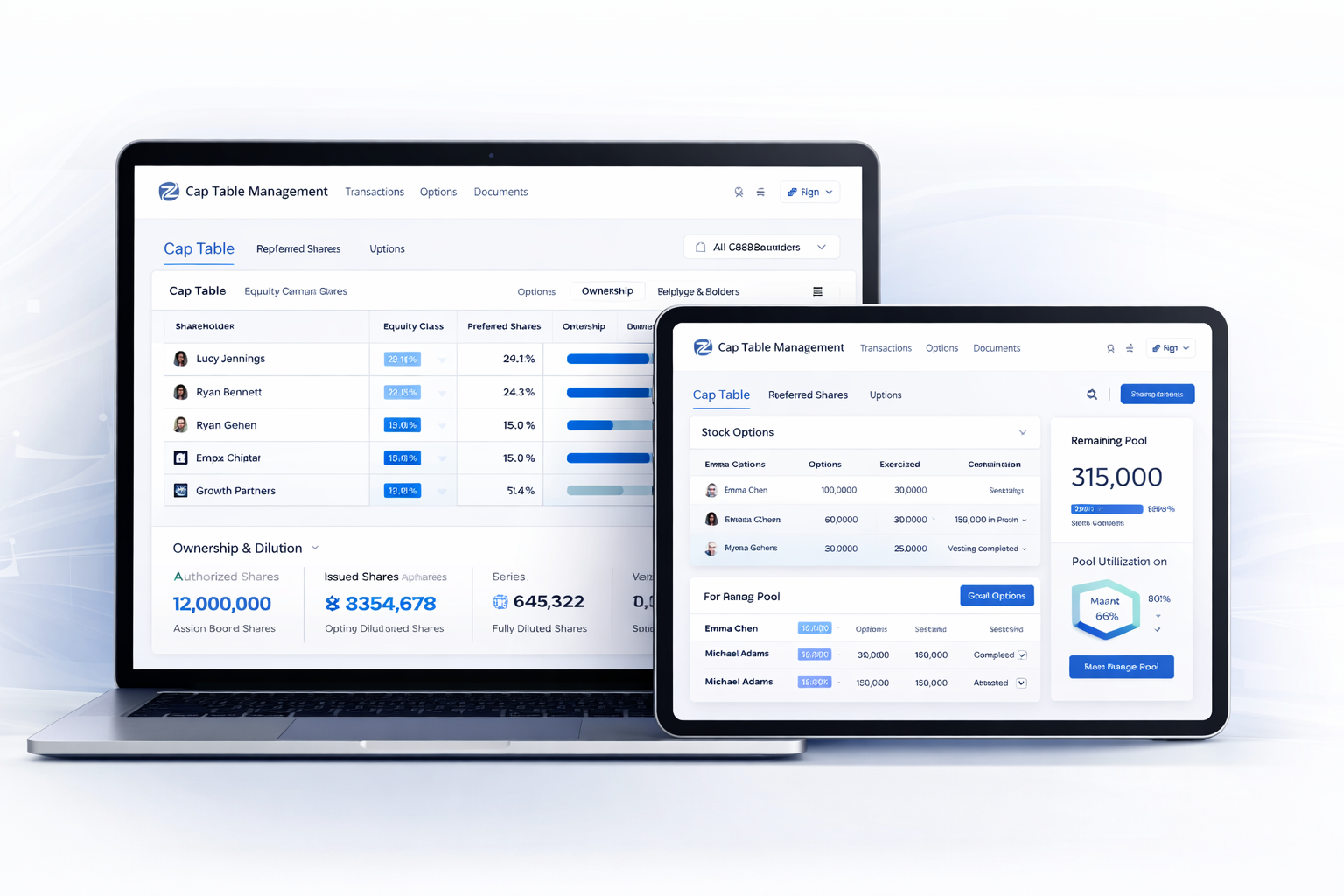

Cap Table Management

Centralized Cap Table Management for CPA & Advisory Firms

Simplify cap table management, ASC 820 & IRS 409A valuations, and generate audit-ready reports with confidence.

ZimbsTech – Innovative Software Solutions for Modern Businesses

Simplify cap table management, ASC 820 & IRS 409A valuations, and generate audit-ready reports with confidence.

ZT Valuation simplifies cap table management by providing a centralized, real-time view of company ownership. Track shareholders, equity issuances, and option grants with complete accuracy—without spreadsheets or manual errors. Designed for founders, finance teams, and CPA firms who demand precision and audit-ready records.

ASC 820 defines fair value as a market-based measurement, not an entity-specific estimate. The standard focuses on how independent market participants would price an asset or liability at the measurement date under current market conditions.

By emphasizing market participant assumptions, ASC 820 promotes consistency across financial reporting periods and improves comparability between companies, funds, and industries.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Under ASC 820, fair value represents an exit price—the amount that would be received upon selling an asset or transferring a liability, rather than the price originally paid to acquire it.

The measurement assumes an orderly transaction between independent market participants as of a specific valuation date. When available, observable market inputs are prioritized over internal assumptions to enhance reliability, audit defensibility, and financial reporting confidence.

ASC 820 establishes a fair value hierarchy that prioritizes valuation inputs based on their observability in the market. The hierarchy improves consistency and comparability by emphasizing observable inputs whenever available.

Level 1 inputs are quoted prices in active markets for identical assets or liabilities that the entity can access at the measurement date.

Examples: Publicly traded equity securities, exchange-traded instruments.

Level 2 inputs include observable inputs other than quoted prices, such as prices for similar assets, interest rates, yield curves, and market-corroborated data.

Examples: Comparable company multiples, observable market benchmarks.

Level 3 inputs rely on internal assumptions when observable market data is not available and reflect management’s best estimate of market participant assumptions.

Examples: Private company equity, complex or illiquid financial instruments.

ASC 820 allows multiple valuation approaches depending on the nature of the asset or liability and the availability of market data. The objective is to maximize the use of observable inputs whenever possible to ensure reliable and auditable fair value measurements.

The market approach estimates fair value by referencing prices and relevant information generated by market transactions involving identical or comparable assets.

This approach is commonly applied when reliable market data and comparable company or transaction information is available.

Common use: Comparable company analysis, precedent transactions.

The income approach converts expected future economic benefits into a present value using appropriate discount rates that reflect risk and timing of cash flows.

It is widely used when value is driven by forecasted cash flows and risk-adjusted return assumptions.

Common use: Discounted cash flow (DCF), option pricing models.

The cost approach reflects the amount that would be required currently to replace the service capacity of an asset, adjusted for obsolescence.

This approach is typically used when assets do not generate direct cash flows or when observable market data is limited.

Common use: Replacement cost, reproduction cost analysis.

Applying ASC 820 ensures fair value measurements are transparent, consistent, and defensible across financial reporting, audits, and regulatory reviews.

Valuations are aligned with U.S. GAAP requirements and supported by documented assumptions, methodologies, and market data.

Standardized measurement principles ensure consistency across reporting periods, entities, portfolios, and asset classes.

Supports compliance with regulatory scrutiny by reflecting how independent market participants would price assets or liabilities.

Minimizes valuation disputes by prioritizing observable inputs and clearly separating market data from management assumptions.

Enhances the reliability of balance sheets, disclosures, and impairment assessments used by auditors, investors, and stakeholders.

Applicable to financial reporting, portfolio valuations, business combinations, impairment testing, and complex instruments.

While ASC 820 and 409A both involve fair value concepts, they serve different purposes and are applied in different financial and regulatory contexts.

ZT Valuation supports finance teams, CPA firms, and investment professionals with accurate, transparent, and audit-ready fair value measurements aligned with ASC 820 requirements.

Every ASC 820 valuation includes clearly documented assumptions, methodologies, and supporting analysis designed to withstand audit scrutiny.

Our reports align with auditor expectations and U.S. GAAP disclosure requirements, reducing review cycles and follow-up questions.

Valuations leverage market participant assumptions, observable inputs, and accepted valuation approaches consistent with ASC 820 guidance.

Seamlessly connect ASC 820 valuations with cap table management, equity modeling, and 409A workflows in one unified system.

Maintain consistency in assumptions and methodology across reporting periods, improving comparability and governance.

Whether valuing a single asset or a complex portfolio, ZT Valuation scales to support growing organizations and investment structures.

Field Experience

Done Around World

Client Satisfaction

Established On

Response Time