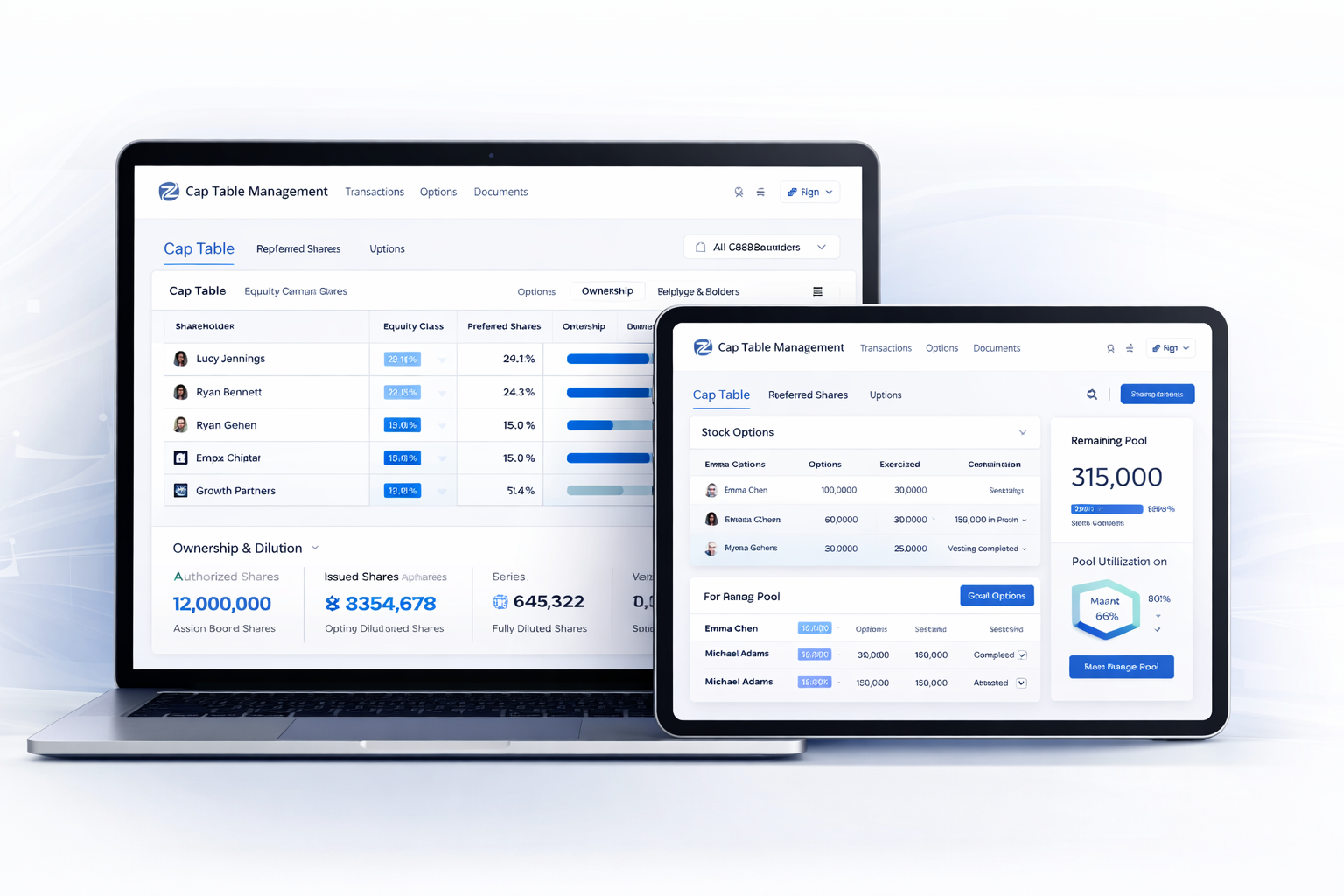

Cap Table Management

Centralized Cap Table Management for CPA & Advisory Firms

Simplify cap table management, ASC 820 & IRS 409A valuations, and generate audit-ready reports with confidence.

ZimbsTech – Innovative Software Solutions for Modern Businesses

Simplify cap table management, ASC 820 & IRS 409A valuations, and generate audit-ready reports with confidence.

ZT Valuation simplifies cap table management by providing a centralized, real-time view of company ownership. Track shareholders, equity issuances, and option grants with complete accuracy—without spreadsheets or manual errors. Designed for founders, finance teams, and CPA firms who demand precision and audit-ready records.

Everything required to maintain clean, accurate, and audit-ready ownership records across every stage of company growth.

Maintain a single source of truth for founders, investors, employees, and advisors holding equity in the company.

Eliminates spreadsheet conflicts and ensures every stakeholder works with the same accurate ownership data.

Track common shares, preferred shares, and authorized equity with precise issued and outstanding share counts.

Clearly separate equity classes to support governance, reporting, and future financing events.

Record equity grants, transfers, cancellations, and repurchases with complete transaction history.

Provides full visibility into ownership changes and supports internal controls and approvals.

Manage employee stock options including grants, vesting schedules, exercises, and expirations.

Track remaining option pool balances to support hiring plans and equity compensation decisions.

Automatically calculate ownership percentages based on issued, outstanding, and reserved shares.

Ensures precise dilution visibility after every equity transaction or funding event.

Maintain a detailed audit trail of all equity-related activities and historical cap table changes.

Supports audits, due diligence, and regulatory reviews with confidence.

Control visibility and edit permissions for founders, finance teams, auditors, and advisors.

Protect sensitive ownership data while enabling secure collaboration.

Ensure all equity actions align with board approvals and internal governance policies.

Reduces risk of errors and maintains long-term cap table integrity.

Designed to support every stakeholder involved in ownership, equity management, and financial decision-making.

Always maintain a clear view of who owns what and how equity evolves over time.

Make confident decisions around hiring, fundraising, dilution, and equity allocation.

Maintain accurate, up-to-date ownership records for reporting and internal controls.

Reduce reconciliation effort and ensure cap table data is always audit-ready.

Review ownership structure, equity classes, and dilution impact with full transparency.

Build trust through consistent and reliable cap table reporting.

Access clean, structured cap table records without manual follow-ups.

Complete audits, reviews, and due diligence faster and with confidence.

Maintain equity records aligned with board approvals and legal documentation.

Reduce compliance risk with a complete, traceable equity audit trail.

Manage employee equity, option grants, and vesting schedules with clarity.

Support hiring and retention with transparent equity information.

Proven practices to keep your cap table accurate, transparent, and always ready for growth, fundraising, and audits.

Maintain all ownership and equity data in one centralized system to avoid conflicting spreadsheets.

Ensures every stakeholder works with accurate, up-to-date ownership information.

Record equity grants, exercises, SAFE conversions, and transfers immediately as they occur.

Prevents data gaps and eliminates manual reconciliation.

Understand ownership impact of new funding rounds, hires, or option grants before committing.

Enables informed negotiations and equity planning.

Attach approvals, grant letters, and documentation to every equity-related transaction.

Simplifies audits, due diligence, and investor reviews.

Share accurate ownership data with founders, investors, and advisors when required.

Builds trust and reduces last-minute data requests.

Ensure your cap table can be shared instantly without fixing errors or missing history.

Helps you move faster during fundraising discussions.

A simple, structured flow founders and finance teams actually follow when setting up a cap table.

Define authorized shares, equity classes, and the total number of shares your company can issue.

Creates a clear foundation before adding founders, investors, or option pools.

Record how much equity each founder owns, including any vesting terms.

Locks in the initial ownership structure and aligns the founding team early.

Add investment details including share class, price, and number of shares issued.

Provides visibility into post-money ownership and future dilution.

Set aside shares for employee stock options and record existing grants if applicable.

Helps plan future hiring and understand fully diluted ownership.

Validate ownership percentages after every equity event or funding round.

Ensures accuracy before reporting, valuation, or investor discussions.

Keep the cap table updated as new grants, exercises, and transactions occur.

Prevents errors and keeps the cap table audit-ready at all times.

Field Experience

Done Around World

Client Satisfaction

Established On

Response Time